Paul B Insurance Medigap Things To Know Before You Buy

Wiki Article

The Of Paul B Insurance Medigap

Table of ContentsFascination About Paul B Insurance MedigapTop Guidelines Of Paul B Insurance MedigapWhat Does Paul B Insurance Medigap Do?Paul B Insurance Medigap Can Be Fun For AnyoneHow Paul B Insurance Medigap can Save You Time, Stress, and Money.An Unbiased View of Paul B Insurance Medigap

You've possibly discovered that Medicare is somewhat different from medical insurance prepares you have actually had before. Before Medicare, your plan most likely included medical and prescription insurance coverage. And also if you had medical insurance with job, you most likely had dental as well as vision insurance coverage, also. Original Medicare, or Medicare you get from the federal government, just covers medical and also healthcare facility advantages.

The Best Strategy To Use For Paul B Insurance Medigap

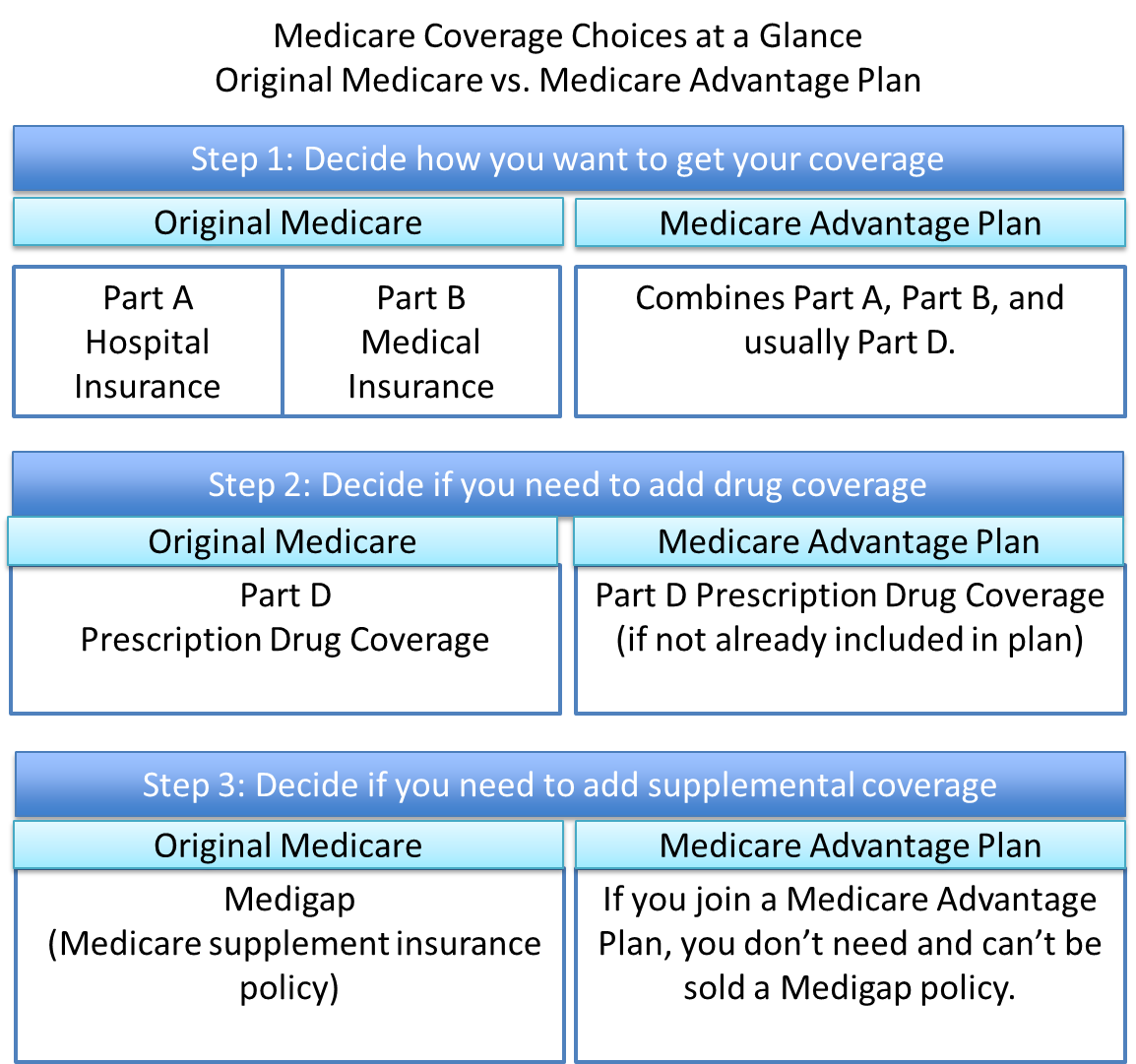

Medicare health strategies offer Component A (Healthcare Facility Insurance Policy) and also Component B (Medical Insurance policy) advantages to people with Medicare. These plans are typically used by personal firms that contract with Medicare. They include Medicare Advantage Program (Component C) , Medicare Expense Strategies , Demonstrations / Pilots, as well as Program of All-encompassing Look After the Elderly (SPEED) .1 As well as given that you aren't ready to leave the labor force simply yet, you may have a brand-new option to think about for your clinical protection: Medicare. This short article compares Medicare vs.

The Paul B Insurance Medigap Ideas

The difference between private in between insurance wellness Medicare and also that Medicare is mostly for mainly Americans Specific and older and also surpasses private goes beyond personal in insurance policy number of coverage choicesProtection while private health exclusive allows insurance coverage for protection.

If you pick a Medicare combination, you can compare those kinds of plans to discover the very best premium and insurance coverage for your requirements. Select a plan mix that matches your demands, and after that view thorough details regarding what each strategy will certainly cover. Beginning comparing plans now. Original Medicare Original Medicare (Parts An as well as B) provides medical facility and also medical insurance.

The Single Strategy To Use For Paul B Insurance Medigap

For instance, Original Medicare will not cover dental, vision, or prescription medicine coverage. Initial Medicare + Medicare Supplement This mix includes Medicare Supplement to the standard Medicare coverage. Medicare Supplement plans are designed to cover the out-of-pocket expenses left over from Initial Medicare. These plans can cover coinsurance amounts, copays, or deductibles.Medicare Advantage (with prescription medicine protection included) Medicare Benefit (Component C) plans are sometimes called all-in-one plans. In enhancement to Component An and also Component B protection, many Medicare Benefit plans consist of prescription medicine plan insurance coverage.

Medicare is the front-runner when it comes to networks. If you don't desire to stick to a limited number of doctors or healthcare facilities, Initial Medicare is likely your best choice.

Examine This Report about Paul B Insurance Medigap

These areas as well as people comprise a network. If read this you make click here for more info a go to outside of your network, unless it is an emergency, you will certainly either have restricted or no coverage from your medical insurance strategy. This can get costly, particularly given that it isn't constantly very easy for people to recognize which companies as well as locations are covered.

This is an area where your exclusive Affordable Treatment Act (ACA) or employer strategy may beat Medicare. The typical monthly employer premium is $108. 2 While many people will certainly pay $0 for Medicare Component A costs, the standard costs for Medicare Part B is $170. 10 in 2022. 3 Parts An and also B (Initial Medicare) are the fundamental building blocks for coverage, and also postponing your registration in either can lead to financial fines.

These plans won't erase your Part B premiums, however they can offer added insurance coverage at little to no cost. The rate that Medicare pays compared to private insurance policy depends on the solutions rendered, and rates can vary. However, according to a 2020 KFF study, exclusive insurance coverage settlement prices were 1 (paul b insurance medigap).

Paul B Insurance Medigap Fundamentals Explained

5 times greater than Medicare rates for inpatient medical facility services. 4 The following thing you might consider are your annual out-of-pocket expenses. These include copays, coinsurance, as well as deductible quantities. Medicare has leverage to discuss with doctor as a nationwide program, while exclusive wellness insurance coverage intends bargain as private Learn More business.

You need to also consider deductibles when looking at Medicare vs. personal health insurance policy. The Medicare Part A deductible is $1,556.

It is best to utilize your plan info to make contrasts. Usually, a bronze-level medical insurance strategy will certainly have an annual medical insurance deductible of $1,730. 6 This is a nationwide standard as well as might not mirror what you in fact pay in costs. It is best to use your plan information to make comparisons.

Report this wiki page